Year-End Compliance Checklist for Corporates: Ensure a Seamless Close

Dec 19, 2024

Here's a shocking fact: Companies shelled out over $2.5 billion in compliance-related penalties in a recent year. The real kicker? Simple mistakes in year-end compliance procedures caused 65% of these violations.

Tracking every compliance requirement can feel like a massive challenge. Regulations keep changing, deadlines pile up, and documentation needs become more complex. Your company needs a detailed compliance checklist to guide you through these challenges.

Here is a comprehensive resource to help your year-end closing run smoothly and help you start the new year with confidence. This guide covers everything from regulatory requirements to digital compliance, showing you ways to stay compliant while making your processes more efficient.

Want to keep your company compliant and avoid penalties? Let's tuck into the significant tasks you need to complete.

Essential Regulatory Compliance Tasks

The regulatory requirements for 2025 need our immediate attention. Several compliance tasks must be handled quickly and carefully as we begin the new year.

Corporate Transparency Act Requirements

The new Corporate Transparency Act (CTA) came into effect January 1, 2024. These are the significant deadlines for beneficial ownership information reporting:

Companies formed before 2024: File by January 1, 2025

Companies formed in 2024: File within 90 days of formation

Companies formed after January 1, 2025: File within 30 days of formation

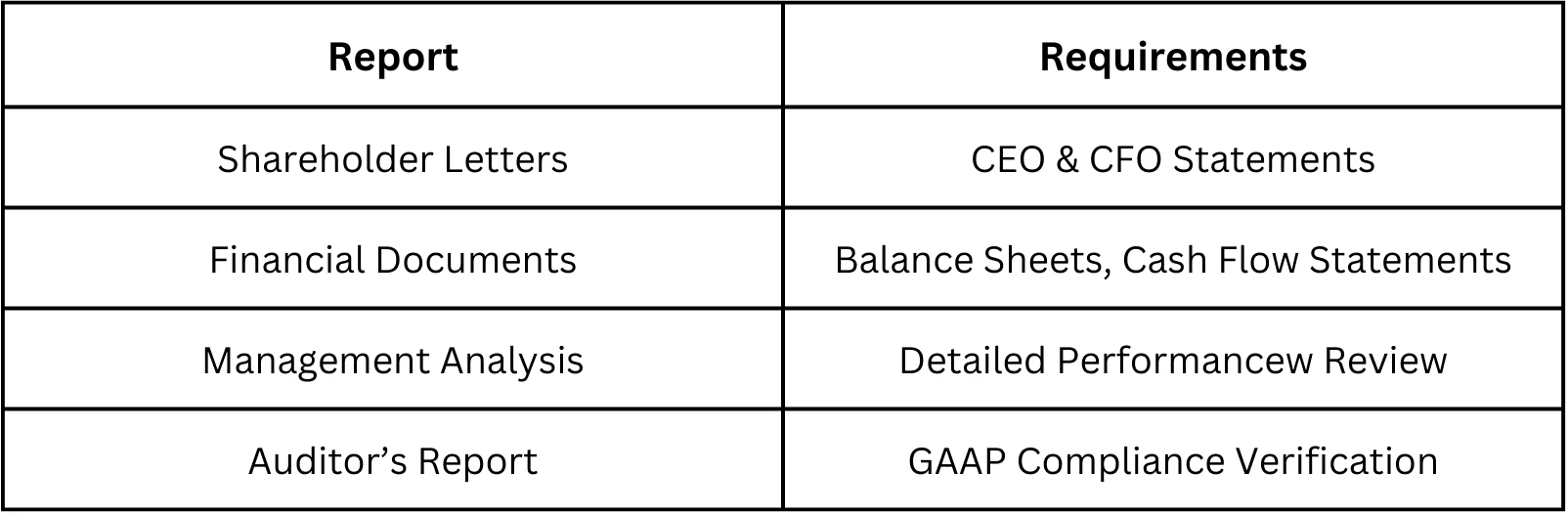

Annual Reports and Financial Statements

A detailed annual reporting process forms the core of our corporate compliance checklist. These are the essential components:

Tax Compliance Documentation

Tax compliance records must be meticulously maintained year-round. Federal and state tax obligations need tracking, and documentation of tax payments must be accurate. Companies operating in multiple jurisdictions should use a systematic approach to monitor various deadlines and requirements.

Non-compliance can result in severe penalties. Civil penalties can reach $500 per day, and criminal charges may apply for willful violations. Our compliance checklist helps companies meet all regulatory obligations accurately and on time.

Digital Compliance and Data Protection

Protecting our organization's data assets is crucial in today's digital world. A corporate compliance checklist should adapt to handle complex digital threats and privacy regulations effectively.

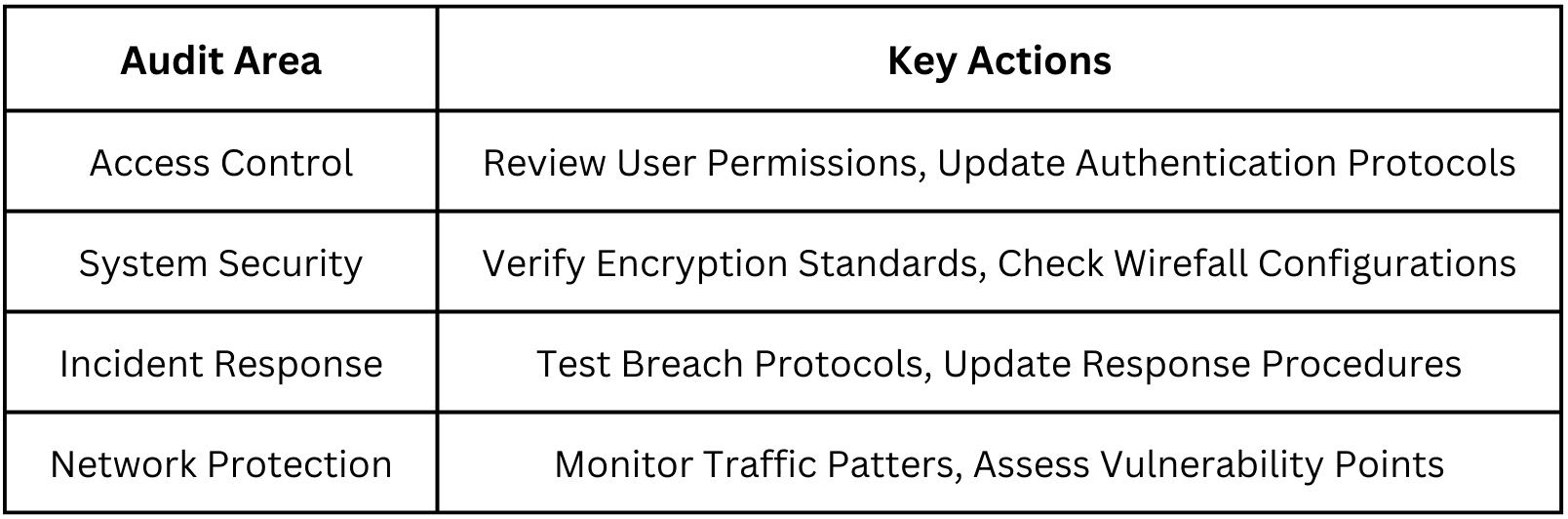

Cybersecurity Audit Checklist

Quarterly cybersecurity audits should follow this framework:

Data Privacy Compliance Review

A solid data privacy compliance strategy protects sensitive information while keeping operations efficient. The implementation requires:

Reliable encryption for data at rest and in transit

Clear data classification and handling procedures

Regular privacy impact assessments

Monitoring and logging of all data access activities

Digital Records Management

A complete digital records management system ensures compliance and data integrity. The system needs automated backup systems, retention schedules, and audit trails for all digital documents.

These digital compliance measures strengthen your security when integrated into regular operations. One should keep up with emerging threats and compliance requirements through regular system testing and updates.

Corporate Governance Review

A resilient corporate governance system plays a vital role in the compliance checklist. A detailed corporate compliance checklist will give a clear path to meet governance requirements and protect stakeholder interests.

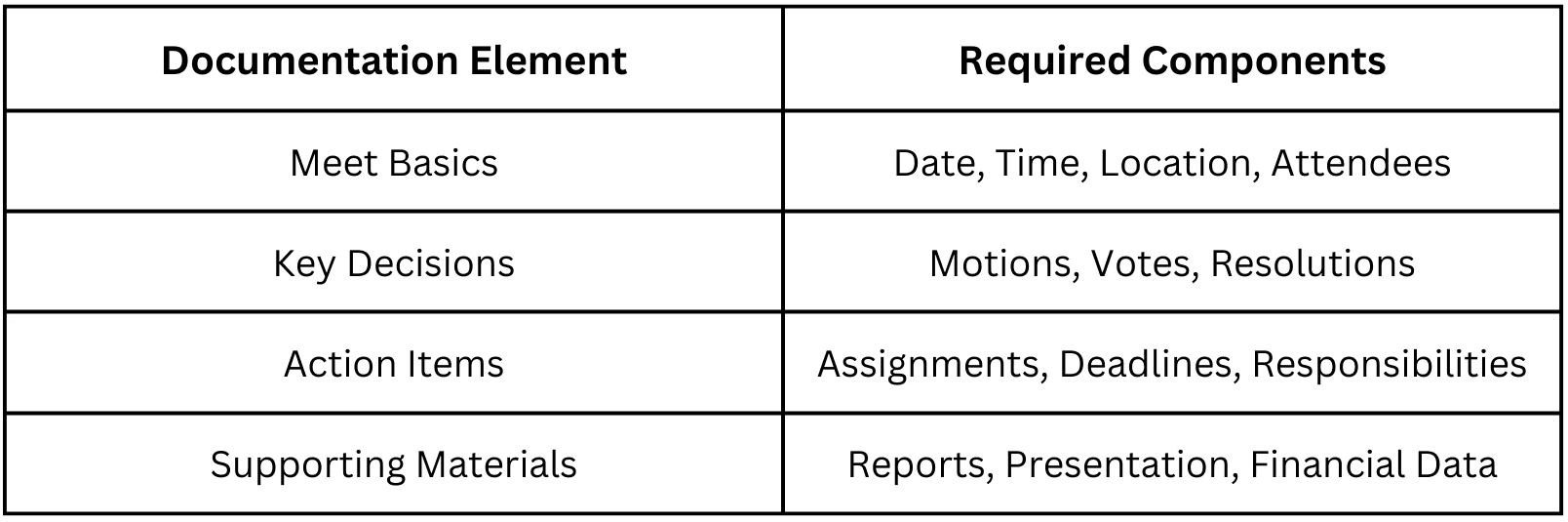

Board Meeting Minutes and Documentation

Proper documentation of board meetings serves as the lifeblood of corporate governance. The records include:

Shareholder Communications Update

One should value transparent communication with shareholders and keep them updated regularly. A holistic strategy centers on active participation with major shareholders. You should address their concerns about strategic decisions and capital allocation. All communications are properly documented and archived to maintain compliance.

Policy and Procedure Reviews

The policy review process includes these vital steps:

Review all governance policies twice a year

Procedures get updates based on regulatory changes

Review outcomes and approval processes are documented

Changes are implemented through proper channels

Updated policies are monitored for effectiveness

A standard format applies to all policy reviews in the corporate compliance checklist. This organized approach helps maintain good governance. A solid strategy should help you adapt smoothly to business changes and new regulatory requirements.

Technology-Driven Compliance Management

Technology plays a vital role in making corporate compliance checklists work. The right tech solutions help change compliance management from just reacting to problems to preventing them.

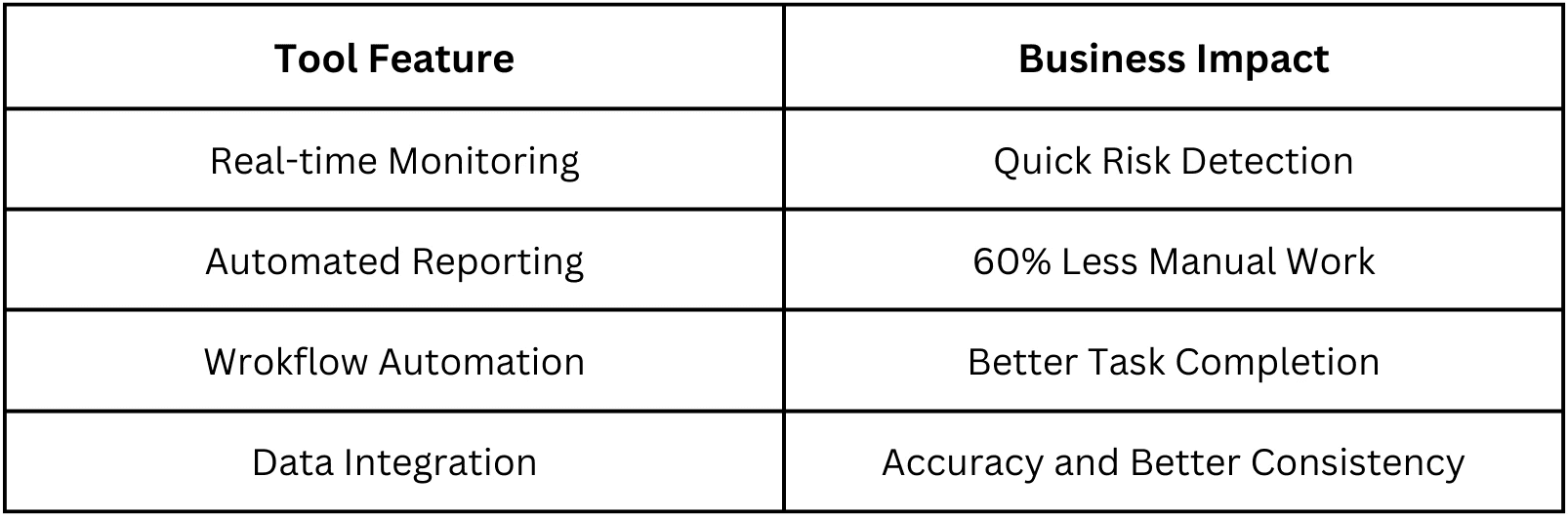

Compliance Automation Tools Assessment

Assess automation tools by how well they simplify the compliance processes. Here's what to look for:

Digital Compliance Tracking Systems

Digital tracking systems give you a complete view of the compliance status in all departments. The advanced monitoring tools help with:

Keeping immediate compliance dashboards

Creating automated compliance reports

Tracking policy changes

Staying updated with regulatory changes

Integration with Enterprise Systems

Combining compliance tools with current enterprise systems makes work easier. Integrated compliance platform works naturally with:

ERP systems to handle financial compliance

HR systems to manage workforce rules

CRM platforms to protect customer data

Putting all the compliance management into one tech system has made everything more accurate. You spend less time on manual tasks. This setup helps keep the corporate compliance checklist up-to-date and working well across the company.

Conclusion

Year-end compliance management needs attention across all business operations. This complete checklist helps companies guide through regulatory requirements, digital compliance, corporate governance, and technology integration.

These compliance measures protect organizations from getting pricey penalties and make the operational framework stronger. You should monitor regulatory changes and pair them with resilient digital security measures. Simplified governance processes build a foundation that stimulates business growth.

Companies that follow this well-laid-out approach reduce compliance risks. They build stronger, more adaptable organizations ready to tackle future challenges.

FAQs

What is a corporate compliance checklist? A corporate compliance checklist is a comprehensive tool that outlines specific tasks, procedures, and requirements that organizations must follow to adhere to laws, regulations, industry standards, and internal policies. It helps companies navigate regulatory requirements, digital compliance, corporate governance, and technology integration effectively, ensuring they stay compliant and avoid costly penalties.

Why is year-end compliance important for corporations? Year-end compliance is crucial for corporations because it helps them close the year smoothly and start the new one confidently. It ensures that all regulatory obligations are met, financial statements are accurate, tax compliance is maintained, and corporate governance is robust. Proper compliance management protects organizations from costly penalties and strengthens their operational framework for sustainable business growth.

What are some key components of a year-end compliance checklist? Key components of a year-end compliance checklist include:

Essential regulatory compliance tasks (e.g., Corporate Transparency Act requirements, annual reports, tax compliance documentation)

Digital compliance and data protection measures

Corporate governance review (board meeting documentation, shareholder communications, policy reviews)

Technology-driven compliance management (automation tools, digital tracking systems, integration with enterprise systems)

How can technology improve compliance management? Technology can significantly improve compliance management by:

Automating compliance processes and reducing manual effort

Providing real-time monitoring and immediate risk identification

Enabling automated reporting and comprehensive visibility into compliance status

Facilitating integration with existing enterprise systems for more efficient workflows

Helping track regulatory changes and updates more effectively

What are the consequences of non-compliance for corporations? Non-compliance can result in severe consequences for corporations, including:

Substantial financial penalties (companies paid over $2.5 billion in compliance-related penalties in 2022)

Civil penalties of up to $500 per day for certain violations

Potential criminal penalties for wilful violations

Damage to reputation and loss of stakeholder trust

Operational disruptions and legal challenges