Simplifying Entity Management for Accounting and Finance

Mar 29, 2023

Legal operations and entity management are vitally important for accounting firms working in the United States to stay organized and compliant with regulatory standards. The finance industry demands precision and accuracy, from shareholder reporting to risk management policies at every level. From tax and banking to securities and capital investments, accounting firms handle numerous financial transactions for clients, which require various entities; however, tracking the entire process can become time-consuming.

Fortunately, with the implementation of entity management software such as Traact, accounting firms have access to user-friendly tools that provide an efficient way to manage existing entities and easily create new ones. The right entity management solutions combine power and scalability to provide financial professionals with the essential tools to maintain comprehensive records of their organization's accounts. In addition, entity management solutions can be tailored to suit even the most advanced needs of accounting firms, making it easier to safeguard data and ensure accuracy across the organization.

Financial firms in the United States are responsible for a significant amount of the country's legal operations and need to take entity management seriously. This involves ensuring all relevant accounting and finance processes – including audits, taxes, and financial reporting – are maintained in line with state and federal regulations. Additionally, compliance with all applicable laws is another integral part of maintaining financing entities, from gathering customer data to using protocol-driven processes that help a company avoid potential legal issues. This kind of due diligence can be complicated but necessary to ensure a business stays afloat during economic downturns or unexpected disasters.

A software solution to help manage this process will save time, money, and resources. Entity management software can automate the tedious tasks associated with accounting processes such as financial statements, budgeting, forecasting, and audits. Streamlining these procedures provides more time for planning and strategizing to secure more significant returns. It can also provide visibility into operational areas needing improvement and allow users to leverage critical insights from vital documents like contracts or tax filings. As a result, entity management software is a valuable investment for any financial firm that seeks to be successful in today's marketplace.

Accounting firms can leverage automated entity management solutions in several ways to improve their services and operations:

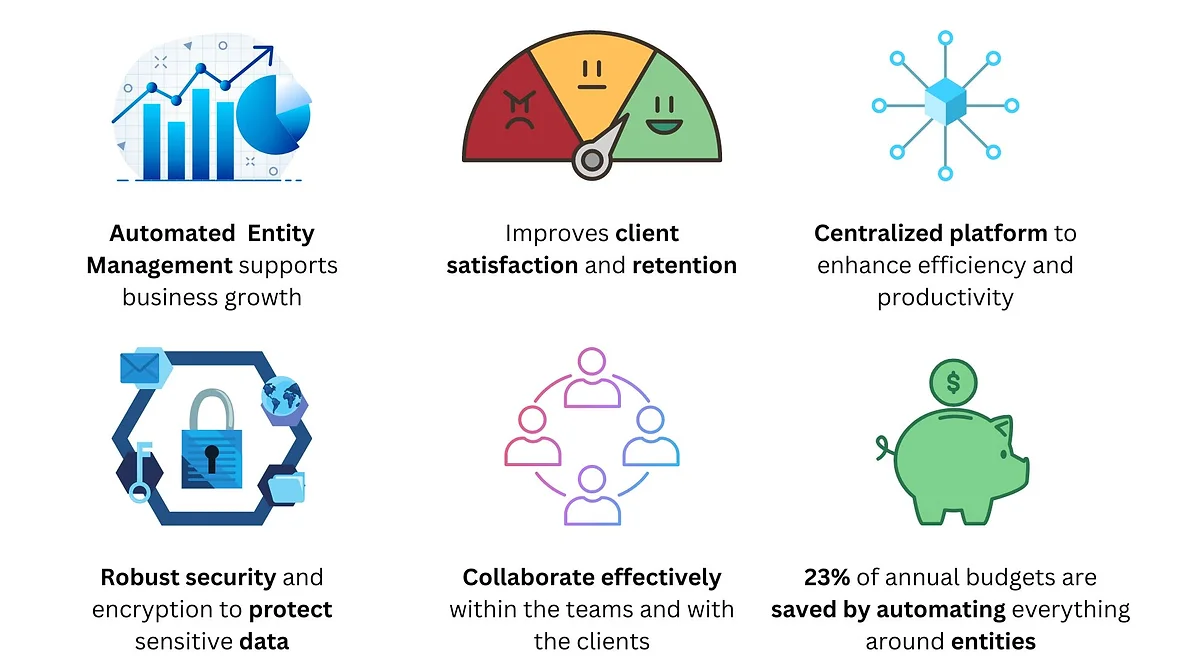

Streamlining Entity Management: Automated entity management solutions can help accounting firms streamline their entity management processes, reducing manual effort and minimizing errors. This can free up time for staff to focus on higher-value tasks, such as advising clients and providing strategic insights.

Compliance Management: Compliance is a critical aspect of entity management, and accounting firms can leverage automated solutions to help their clients stay compliant with regulations. Accounting firms can help their clients avoid penalties and maintain their legal and regulatory obligations by automating compliance tracking and reporting.

Real-Time Data Insights: The automated solution can provide real-time data insights on entity structures, compliance status, and other vital metrics. These insights can help accounting firms make informed decisions and give better advice to clients.

Improved Communication and Collaboration: Automated entity management solutions can facilitate communication and collaboration between accounting firms and their clients. By providing a centralized platform for entity management, accounting firms can improve communication and reduce miscommunications, leading to more efficient and effective client service.

Cost Effective: Automated entity management solutions can help accounting firms reduce costs associated with entity management. By minimizing manual effort and reducing the risk of errors, firms can save time and money on administrative tasks.

Automated entity management solutions can help accounting firms improve their services and operations, providing a more streamlined, efficient, and practical approach to entity management.

The technology offers a host of benefits for accounting firms looking to streamline entity operations. By automating entity tasks such as entity compliance, entity filing, entity tracking and reporting, and due diligence, these systems provide greater accuracy, faster processing times, increased efficiency in managing entity information, reduced risk of noncompliance errors, and cost savings. In addition, as the business world continues to evolve with digital technologies, using an automated entity management system is essential for any firm that wants to stay competitive in today's market.

As the accounting industry continues to evolve, entity management automation will become an increasingly important tool for firms looking to stay competitive and provide value-added services to their clients. Book a free demo to learn how Traact can offer better solutions for your entity management.