How a Good Standing Certificate Can Save Your Business

Feb 24, 2023

The numerous hoops that must be jumped through to maintain compliance are all too well known to small business owners. Every state has its own set of laws governing the operation of corporations and limited liability companies, ranging from tax laws to permit requirements. Owners could be requested to present a certificate of good standing, particularly if they want to apply for a loan or find a possible investor. The entity complies with all state standards, as evidenced by this certificate. From a straightforward, cost-free online form to a more expensive, quicker mail-in option, getting a copy is easy. Of course, it all depends on which state the company is located in. So let's dive deep and see how obtaining a Good Standing certificate saves you from numerous hassles.

Before we begin, let's look at an example to understand how vital a Good Standing Certificate is. You own a company in California, but for some reason, you miss out on an annual report filing or non-payment of franchise taxes. The state gives a grace period of one whole year to rectify it before it revokes your business. In such a case, you may have to pay heavy fines or shut down your business.

In another scenario, a third party can claim your business, forcing you to renew all the contracts again. Additionally, they can try to resell all the rights back to you and demand a huge sum in return. This process is time-consuming, involves a lot of back and forth with your employees and clients, and costs you a fortune. Therefore, tracking your compliance documentation using modern corporate solutions software is always advisable to avoid landing in troubled waters.

Let's understand the essence of Good Standing. A Certificate of Good Standing often certifies that the organization has submitted all required reports and payments to the Secretary of State's (SoS) office. In addition, it confirms that the organization is real and has legal standing to conduct business in the state.

The state rules governing business entities differ. For example, a "Certificate of Good Standing," "Certificate of Existence," "Certificate of Authorization," or a phrase to that effect may be the name given to the document by the state.

What are the eligibility criteria?

Most states allow registered business entities—including corporations, partnerships, LLCs, and limited liability companies (LLPs)—to ask for a certificate of good standing. Businesses should have their yearly reports, fees, and designated registered agents in order before applying for a certificate.

Unincorporated businesses include sole proprietorships and general partnerships. However, they cannot receive a certificate of good standing since they are not registered with the state.

When is a Certificate of Good Standing required?

Owners are not required to have a letter of good standing for everyday business operations. But at some point throughout the existence of an entity, obtaining a certificate may be required. Typical justifications for requiring a certificate of good standing include the following:

Opening a bank account for a business

Requesting business financing

Requesting money from prospective investors

Establishing a corporate presence in another state

Contracting with a different business

Selling or transferring a business

Circumstances under which a company risks its Good standing

The idea of "evidence" behind a certificate of good standing is relatively straightforward. However, any lapse in good standing raises a compliance concern that must be addressed immediately.

Typical causes for an organization losing its "good standing" status include:

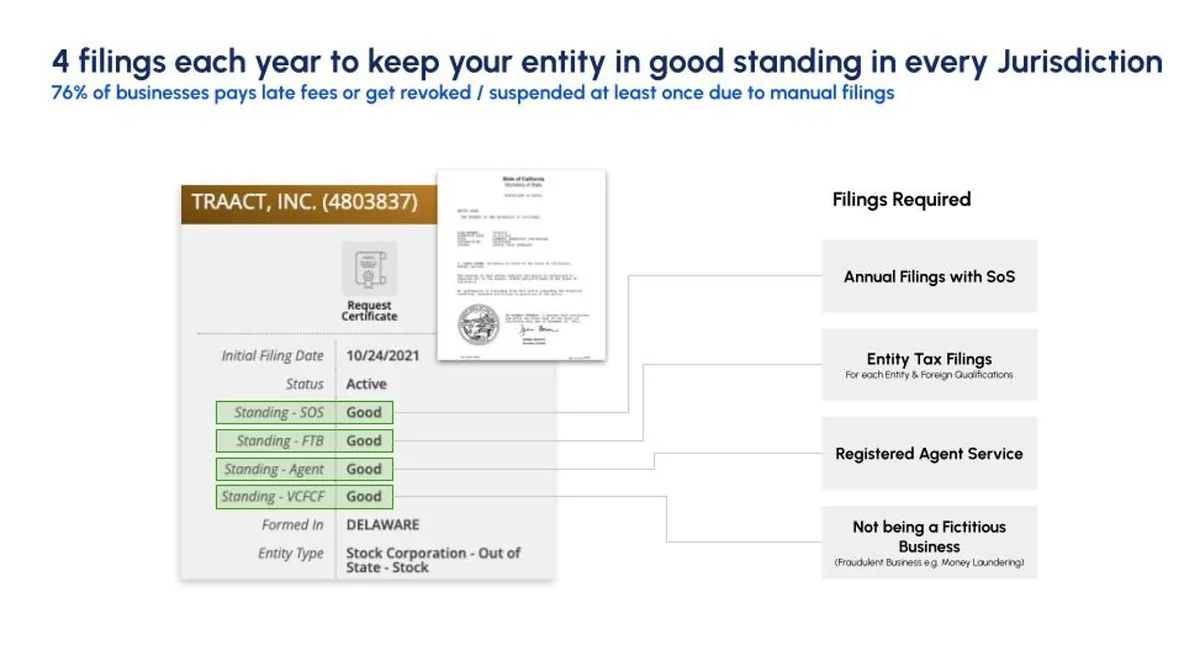

Failing to submit yearly reports on schedule

Failing to keep a registered agent or registered office up to date

Failing to pay franchise taxes on time

The repercussions of not being in Good Standing

An adverse status change with the state is typically the result of your business not complying with state rules or standards. Before enacting an undesirable status change, some states offer great chances for correction, while others do not.

Companies that don't comply and lose their good standing may be subject to fines or other penalties from the state. Even the administrative dissolution of the business and the loss of the limited liability protections for the persons involved could happen due to a compliance failure.

It's crucial to regularly, ideally monthly, check the status of your entity with the state. It could be time-consuming and challenging to do this manually, depending on how your firm is set up, but it's worth the effort. You can simplify your entity management with the help of Traact, where we automate redundant tasks, become your back office staff, and save you 8-hours of staff time so that you can focus on essential jobs to grow your business. We take on the role of your registered agent and can offer professional assistance in keeping an eye on your company and informing you of any status changes.

To understand how we can better manage your compliance process, book a free consultation today